Forty Seven is a unique project built into the modern monetary system; a bank that will be acknowledged by international financial organizations; a bank that will correspond to all the requirements of regulators.

Vission of Forty Seven Bank

Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibility to level up the whole modern financial system.

Mission of Forty Seven Bank

The mission of Forty Seven Bank and management team is to provide safe, innovative and user-friendly financial services and products to our customers - individuals, businesses, developers, traders, financial and governmental institutions.

Values of Forty Seven Bank

Our range of products will unitecryptoworld and traditional finance world and grant new unique opportunities to both of them.

Our values are:

- -Transparency;

- -Financial stability;

- -Effectiveness and user firendly procedures;

- -Security and privacy (data protection);

- -Innovativeness;

- -Customer satisfaction;

- -Market share growth and worldwide expansion;

- -Profit for all stakeholders.

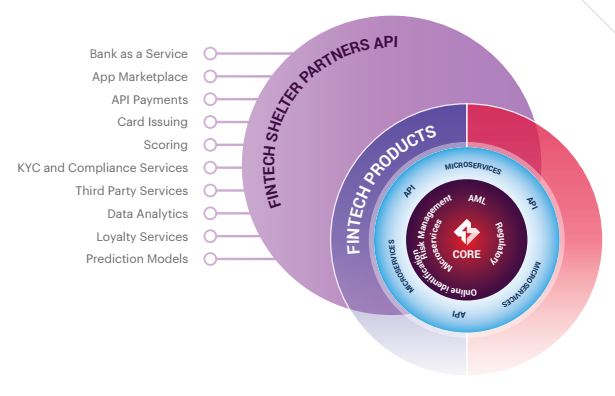

Bank as a Service

Forty Seven Bank will provide White Label solution for those partners who want to create and market the bank under their own brand, but at the same time using our bank's infrastructure for all operations.You can build your own web-site or mobile application and integrate it with Forty Seven Bank infrastruc-ture via White Label API. The Bank as Service API will provide following functionality:

- -Request personal information, bank accounts and financial transactions;

- -Transfer of funds within Forty Seven Bank and to another bank via SEPA;

- -Loan management;

- -Deposit management.

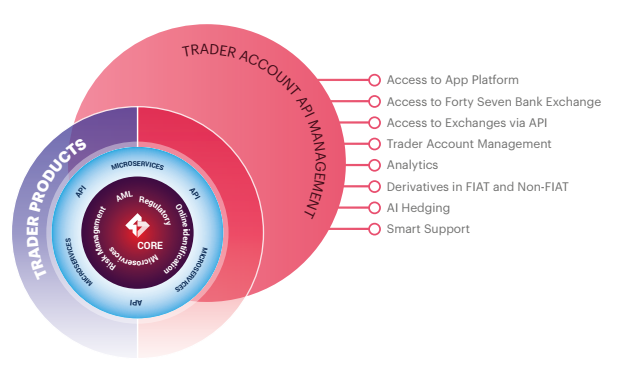

API for Trading Platforms

This API is designed for full featured trading platform that will visualize the trading situation on the market with charts, monitor the balance of trader accounts in real time, open / close trading deals, etc. This API provides the access to bank exchange platform and will provide following methods:

- Request list of customer assets - crypto and fiat currencies and tokens;

- Request balances for customer assets;

- Request traded pairs of assets;

- Request ticker (bid / ask price) for traded pair of asset (can be streamed real time via websocket API);

- Request last trades for traded pair of asset (can be streamed real time via

- websocket API);

- Request order book (changes can be streamed real time via websocket API);

- Place / close / cancel trading order;

- Open / close marginal position.

Forty Seven team is generating funds via Initial Coin Oering (ICO) procedure to make our innovative ideas come true

- to build the bridge between the cryptocurrency world and the traditional monetary system. We will unite the community of digital asset users with more conservative individuals under the roof of Forty Seven Bank.

FORTYSEVEN UNITED is incorporated in London, United Kingdom.

The government of the United Kingdom and regulatory authorities have advanced favorable conditions against cryptocurrencies and other digital asset initiatives.

London itself is a major financial center which provides access to foreign exchange market out of the world's total foreign exchange dealings. Having this in mind could draw a solid base for cryptocurrency services' claims and advancement.

Forty Seven team has completed the experience of developing financial technology products and their full legal registration procedure in the UK regulatory framework - FCA.

About Forty Seven Bank

Forty Seven was founded by the information technologies, finance, economics, marketing and game industry professionals in 2017.

Products and Services

Forty Seven Bank is aiming to provide broad spectrum and individual financial clients.

In the past, Customer Relationship Management (CRM) has changed the approach to the business and customer service.We believe that smart contracts which lead to a new technological revolution.

Products for Business

Synergy of smart contracts and blockchain will open new unbeliev-

tools. Our team is aiming to break through traditionalbanking and step into the new banking perspective using the current innovative exclusive services for future advantage. We are creating the bank of the future.

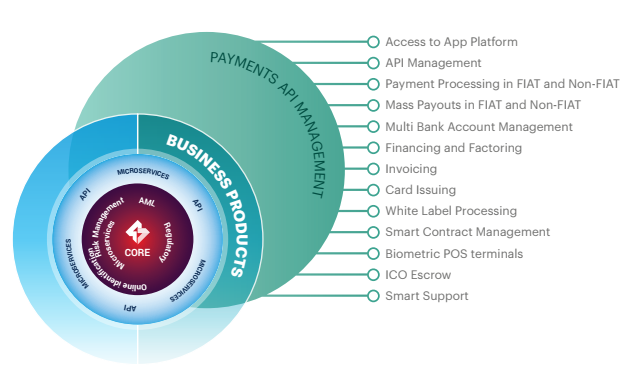

Figure 2 below shows Forty Seven Bank products and services for business clients.

Forty Seven App Platform and API Management

For our business customers, we will oer wide range of financial products and services. All the services will be available via API for management via smart contracts or customer applications. We will allow to create completely autonomous business thanks to full API access to our products and all their functions.

Payment Processing and Invoicing

Forty Seven Bank will provide wide range of payment processing solutions to our business clients. E-commerce clients will have the possibility to easily accept payments on their web-pages, platforms, applications, games, etc.with easy to use and informa-tive merchant cabinets / panels.

They will accept payments in traditional fiat currencies via credit or debit cards (Visa, China UnionPay, MasterCard, Diners) and direct bank trans-fers. Apart from that, entrepreneurs will be able to accept payments in digital currencies with the support of the banks which will provide clearing procedures. At the same time, the bank will provide convenient and eective invoicing services.

Having all these services are provided by Forty Seven Bank, companies will have the opportunity to substantially decrease the costs, increase the eective-ness of working procedures related to financial management and get access to wide audience of potential customers.

Financing and Factoring

We will like our business clients to offer the factories that will help receivables receivables.

The bank will finance, manage and guarantee invoic-es issued by the company via smart contracts.Companies will have wide range of term financing options to cover operational activities, as well as possibility of long-term financing for their development, expansion and growth.Besides that, by integrating machine learning, the bank will help business clients with credit risk profiles of their customers.

White Label Processing

We will provide infrastructure services for finan-cial institutions. Thanks to principal membershipin Visa and MasterCard, we will oer full spectrum of on-line acquiring services and we will provide opportunity to banks and payment processing companies such as SMS, DMS, OCT, P2P, recurrent, motto, reversal, refund and others.

Additionally, we will oer processing of Point-of-Sale (POS) terminals. Apart from that, we will oer card issuing and bin sponsorship servic-es to our partnering financial institutions.

Biometric POS terminals

We will develop a POS terminal software, which will allow users of a bank account to his / her fingerprint, and pay in the store by applying a thumb to the fingerprint scanner attached to the POS terminal .

This technology will increase the effectiveness of payment process in the store, and will provide benefits not only for customers,

but also for business clients, by lowering the amount of queues and increase the amount of sales.

Why ICO?

In our opinion currently ICO is the best and fastest way to attract financing for interesting projects, especially for those that are community driven with the aim to devel-op important infrastructure elements related to cryptocurrencies. We believe that ICO can boost innovation, as attracting funds via ICO procedures companies do not have to go through traditional bureaucratic procedures. Moreover, as ICO is conducted via smart contracts and block-chain, everything is transparent and project authors get full responsibility for successful realization of the idea.

ICO also provides opportunities for people from dierent countries to contribute their digital assets to projects and teams situated in other countries. In traditional economies there are many restrictions and limitations for people to participate in. Promoting non-financial benefits.

Forty Seven Bank provides FSBT tokens for non-financial benefits to our contributors and future holders. However, over time we believe that we will be willing to do so.

ICO Services

Forty Seven Bank is going to provide services for companies that would like to attract financing via ICO. The services will include legal support, escrow arrangements, support in transferring digital currencies into fiat equivalent. We will also develop rating procedures for ICO projects and will be the provider of thorough analysis of interesting projects.

Products for Developers

Products for Traders

Figure 4 below displays Forty Seven Bank products for traders. Wide range of products and services is going to be oered to traders. There will be traditional products, as well as innovative crypto products developed and introduced by Forty Seven Bank.

Royalty Contract

Copyrighted content owners can benefit from royalty smart contract. Forty Seven Bank will develop this contract and oer royalty collection service. This smart contract will:

- -Track ownership rights;

- -Register the usages of copyrighted content;

- -Calculate royalty;

- -Transfer the funds from the accounts of content users to account of content owners.

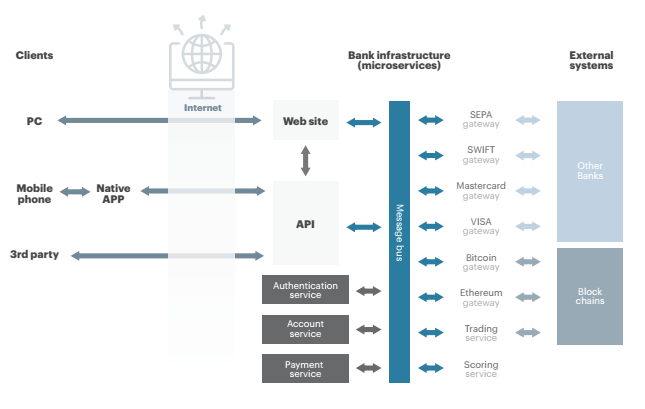

Architecture

The architecture of Forty Seven Bank infrastructure will be built using modern best practices and technologies. All our data will be replicated to many geographically distributed data centers across the globe.The data will be backed up on regular basis. All our execution servers will be duplicated for reliabil-ity.

Distributed computing will be used to provide high level of availability of our banking services. We will use load balancer to distribute network traic to our front ends - APIs and web user interfaces.All our systems will be designed to be able to grow up to scale of billions of users.

API for Payment Initiation Service Providers

This API is designed for use by merchants and other businesses that want to process payments for their customers online, for instance, to purchase goods in online shops. This is the separated part of the API that provides methods to initiate payments within Forty Seven Bank for specific customer:

Internal transfer of funds from one account to another within Forty Seven Bank;

- -Send funds to another bank via SEPA;

- -Mass payments that will allow to send to many recipients at once;

- -Recurring payments (subscriptions) to collect payments periodically.

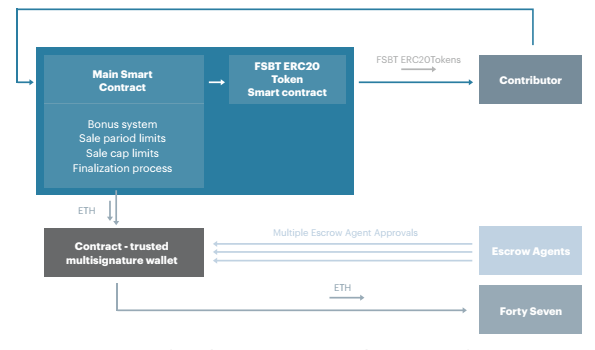

Emission of tokens

What is a Forty Seven Token: It's a token that represents a part in Forty Seven Bank's infrastructure and grants the wielder a priority place in the bank's loyalty program. Holders of FSBT tokens have the right to receive yearly bonuses in the form of FSBL - Forty Seven Bank loyalty tokens.

Besides that, FSBT tokens are a crucial economic part of Forty Seven Bank's ecosystem - they will be needed in order to access the full range of products and services. After the crowdfunding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

FSBT Token

Bonus structure:

- -ICO Round 1: 30% bonus;

- -ICO Round 2: 20% bonus;

- -https: //www.fortyseven.io/ICO Round 3: 0% bonus but bonus for quantity;

Our partners

Team

Advisors

Details Information:

Website: https: //www.fortyseven.io/

Whitepapper: https: //drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

Facebook: https: //web.facebook.com/FortySevenBank/? _rdc = 1 & _rdr

Twitter: https: //twitter.com/47foundation

Telegram: https: //t.me/thefortyseven

author : kaka acong

my profile : https://bitcointalk.org/index.php?action=profile;u=2003664

ETH : 0x94B9422700cb37a581A0971b5495d5557a9Ca084

Tidak ada komentar:

Posting Komentar